A few days ago I received a letter from Chase Card Services. It was polite. It was professionally formatted. It was also a quiet threat dressed up as “customer care”.

In the eyes of Chase Card Services, I am a liability. Not because I pose a risk of default. Quite the opposite. I have a solid credit rating, a product of decades of vigilance, 100% on-time payments and religiously low credit utilization.

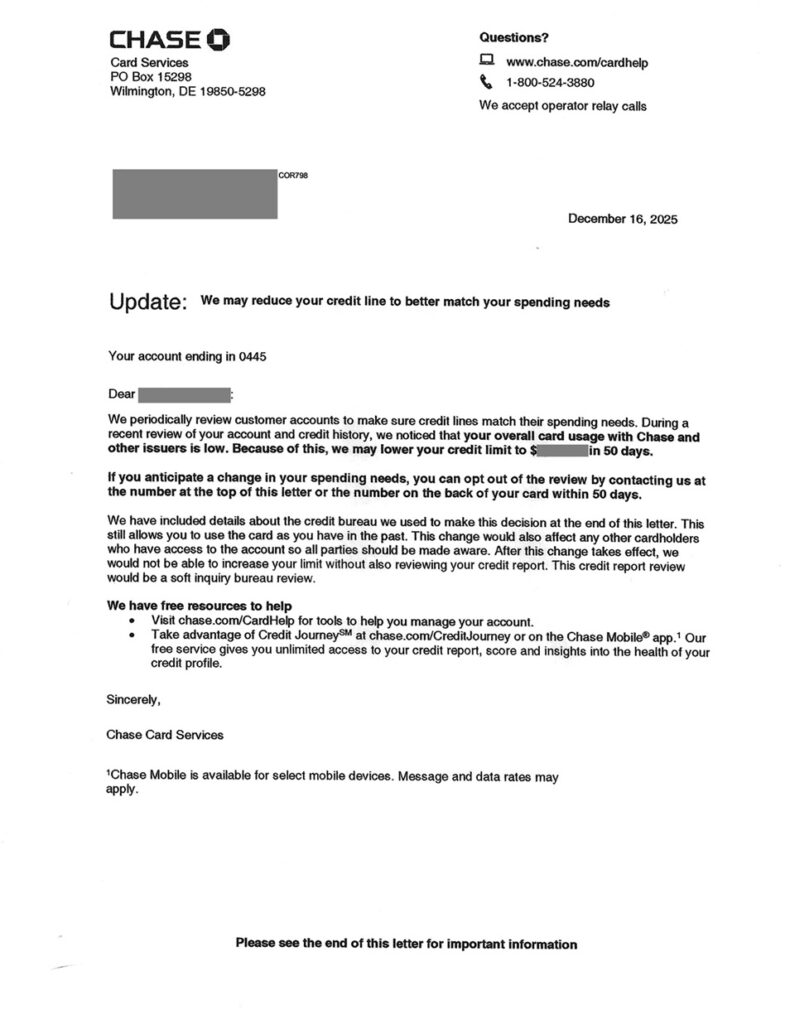

Yet, I recently received this letter:

“During a recent review of your account and credit history, we noticed that your overall card usage with Chase and other issuers is low. Because of this, we may lower your credit limit to $XXXXX in 50 days.”

Stripped of the corporate jargon, the message is clear: “We feel you don’t use our card enough. We don’t find you profitable enough. We will penalize you by reducing your credit limit.”

Chase even gives me a grace period of 50 days to “opt out” of this review by calling them and explaining why I might start spending more. That’s not customer service. That’s a shakedown wrapped in a call-center script.

This action is not a risk management tactic. It is an economic weapon aimed at the responsible consumer and it exposes the predatory nature of the credit card industry.

Let’s Be Clear About the Facts

I’ve had a relationship with Chase for decades. Back when they were handing out credit cards on college campuses like candy, a practice so predatory that it ultimately led to the Credit Card Accountability, Responsibility and Disclosure (CARD) Act of 2009. I was one of the students they “acquired”.

Since then:

- My credit score has been in the 800s for years

- I never carry a balance

- I have never missed a payment

- I keep utilization under 10%, well below the overuse threshold

- I don’t binge-spend, flex or finance a lifestyle I can’t afford

In other words, I’m the customer every credit-score model says is ideal. And that’s precisely the problem. Credit scores reward discipline. Credit card companies do not.

Here’s how FICO actually works:

- 35% Payment history – 100% on-time payments

- 30% Credit utilization – lower is better; under 10% is ideal

- 15% Length of credit history – older is better

- 10% Credit mix – cards, loans, mortgage

- 10% New credit – fewer hard inquiries

I check every box. So what’s Chase’s issue? That’s easy. I’m not carrying interest-bearing debt.

Credit card companies don’t make real money from people like me. They make money from:

- revolving balances

- late fees

- penalty APRs

- behavioral inertia

- financial stress

A customer who pays in full every month isn’t a relationship. They’re a rounding error.

The Myth of Risk Management vs. The Reality of Profit

Credit card issuers generate revenue primarily from two sources: Interest Income (paid by those who carry a balance) and Interchange Fees (paid by merchants when a card is swiped). My responsible usage starves Chase of both.

The Penalty for Low Usage

Chase’s letter claims they review accounts “to make sure credit lines match their spending needs”. That is a half-truth that hides a whole lie. The real reason is portfolio management:

- Risk Reduction: An unused high limit is considered “contingent risk”. If I suddenly maxed out the card during an emergency, Chase would be exposed. By reducing the limit, they cut their potential loss without reducing their already minimal revenue from my account.

- Opportunity Cost: Chase makes no interest income from me. The unused credit line could be extended to a “revolver”, a customer who carries a balance and pays high interest. By reducing my limit, they free up that contingent capital to lend to a more profitable, albeit less responsible, customer.

Risk management would be neutral if paired with consistent rewards for responsible use. Instead, issuers quietly downgrade low-risk customers while aggressively marketing balance transfers and high-APR products to higher-risk ones.

Fact: Interest is the Engine of Profit

Financial data confirms that credit card companies prioritize the customer who is drowning in debt.

- According to Federal Reserve and CFPB data, U.S. credit card issuers collected over $100 billion in interest and tens of billions more in fees annually, with interest income representing the dominant share of profitability.

- The credit function (charging interest on revolving balances) is estimated to make up approximately 80% of credit card profitability for issuers.

- The average Annual Percentage Rate (APR) on credit cards that assessed interest reached 22.8% in 2023, the highest level recorded since 1994, showing an increased margin of profit for banks.

The Chase letter is the sound of an algorithm declaring, “This customer is too financially stable to be profitable.”

The Psychological Weaponization of Credit

This letter isn’t about risk. It’s about ego manipulation. The implied message is simple: “Your credit is being reduced. Something is wrong. You should be worried.”

For many Americans, that threat works.

We live in a materialistic society where status is measured in purchases and appearances. People are pressured to:

- get bigger homes

- upgrade phones

- finance cars

- take debt-fueled vacations

- keep up with neighbors who are also quietly drowning

Credit card companies weaponize that insecurity. Spend more or be downgraded. Carry debt or lose access. Perform consumption or be punished.

And it works. Because fear works.

The predatory sting in this limit reduction is the potential damage to my credit utilization ratio the factor that makes up 30% of my FICO score. My commitment is to keep this ratio below the 10% ceiling. Chase knows the game. They want me to feel that I am losing something and force me to rush out to the store to make that next big purchase, especially now, during the holiday season, when everyone’s profit margin matters most.

I may be safe from the score drop, but the average, financially stretched American is not. The system is designed to use psychological fear to generate profit.

Weaponizing Materialism: The Cycle of Debt

The credit card industry thrives on the gap between what people earn and what they feel they must spend to maintain appearances. They weaponize consumer psychology.

As the letter tries to shame me for “low usage”, it feeds the toxic narrative that financial worth is equated with maxed-out spending.

- A U.S. Federal Reserve survey found that more than a third of Americans could not cover a $400 emergency expense. And as I write this, total outstanding credit card debt has eclipsed $1 trillion for the first time on record.

As Morgan Housel noted in his 2020 book, The Psychology of Money, “Someone driving a $100,000 car might be wealthy. But the only data point you have about their wealth is that they have $100,000 less than they did before.”

Exactly.

Real wealth is invisible.

So is real discipline.

So is saying “no” when the system begs you to say “yes”.

Chase doesn’t want me to be the responsible consumer. They want me to be the person who is $100,000 in debt and still paying 22% interest. That’s their leverage over the average American. We can argue that credit card companies like Chase don’t cause every financial problem in America, but they profit from nearly all of them.

They don’t reward stability.

They don’t reward discipline.

They don’t reward restraint.

They reward dependence. Because once your financial soul is theirs, your money is sure to follow. From your pocket to theirs.

The Irony Chase Won’t Acknowledge

If Chase reduces my credit limit, here’s what happens:

- My utilization still stays below 10%

- My credit score doesn’t meaningfully change

- I still won’t carry a balance

- Chase earns less interchange revenue

- They still don’t charge me interest

This move doesn’t protect Chase.

It doesn’t punish me.

It just reveals their incentive structure.

They aren’t worried about my risk.

They’re worried about my restraint.

And the only way I have to fight them is to cut back on what I put on their card. Financially, there is a victim. I spend less. They lose lunch money.

The letter closes with links to budgeting tools and Chase’s “Credit Journey”. That’s the corporate equivalent of offering insurance coverage after pushing someone down the stairs.

These tools exist to manage consumer behavior, not empower consumers. The goal is spending optimization, not financial independence. Chase’s letter didn’t expose my financial weakness. It exposed theirs.

A Measure of Integrity

Chase’s aggressive past, setting up tables on college campuses to bait students with free T-shirts until the CARD Act of 2009 shut down that unethical practice, is not history. It’s a blueprint.

Their current action is simply a refined tactic, targeting a different consumer segment: those who don’t feed the corporate interest machine.

I checked all the boxes. My credit rating is solid. Chase’s response? A credit cut.

Credit card companies love to market themselves as partners in your financial journey, but true partnerships don’t punish good behavior and real integrity doesn’t require threats.

If your business model depends on people overspending, over-borrowing and feeling anxious when they don’t live up to these downfalls, that’s not financial empowerment. That’s predation with better branding.

The measure of a financial institution’s societal worth should not come with dollar signs, but with the measure of its integrity. By punishing financial prudence and aggressively pursuing interest income, Chase shows they have none. I will simply take my low utilization and my interchange fees elsewhere. The true measure of consumer power is the ability to walk away from a predatory system that profits from your weakness.

And no amount of glossy mailers will change that.

Discover more from Tales of Many Things

Subscribe to get the latest posts sent to your email.